Sarkari Yojana 2024

सरकारी योजना – Sarkari Yojana List & Complete Details

Sarkari Yojana & PM Modi Yojana 2024 - सरकारी योजना (SarkariYojana.Com) वेबसाइट पर पढ़ें प्रधानमंत्री नरेंद्र मोदी और मुख्यमंत्री की सरकारी योजनाओं के बारे में सम्पूर्ण जानकारी और देखें वर्ष 2024 तक लांच की गई सभी सरकारी योजनाओं की सूची विस्तारपूर्वक।

State Wise List of Government Schemes & Latest Updates

Delhi Free Laptop Scheme 2024 for Specially Abled Students of Govt. Schools

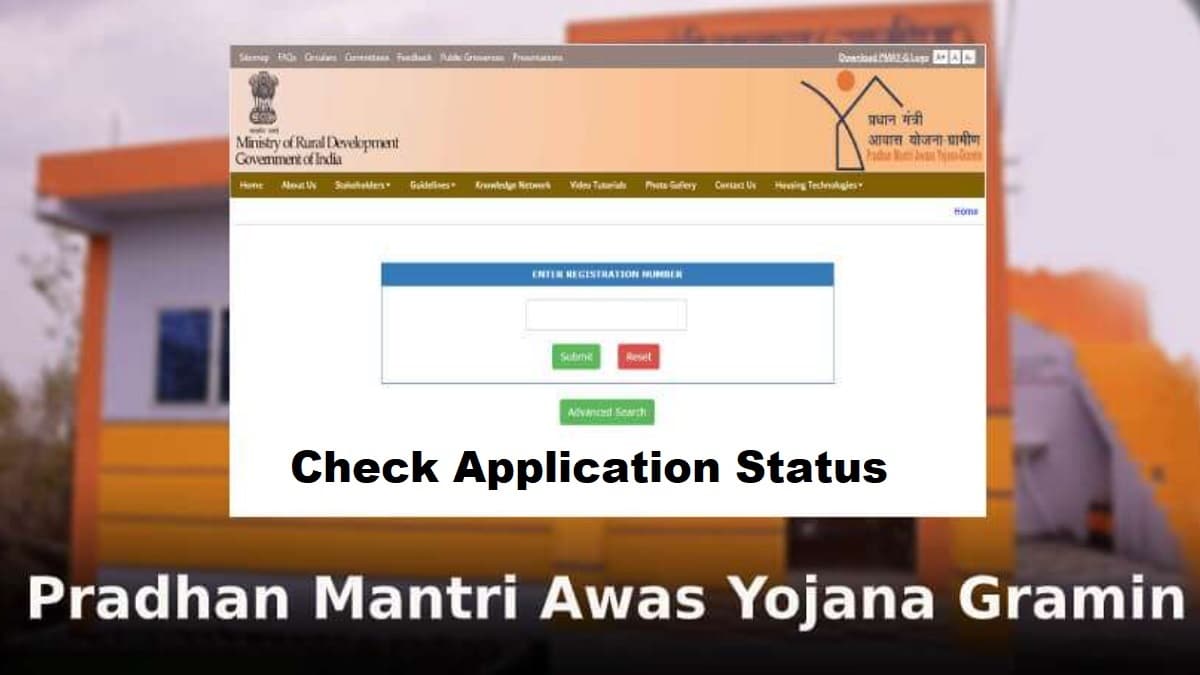

[Apply] Pradhan Mantri Awas Yojana Gramin (PMAY-G) Registration Form 2024 at pmayg.nic.in Online

Apply Online for Bihar SC / ST Civil Seva Protsahan Yojana at scstonline.bih.nic.in – सिविल सेवा प्रोत्साहन योजना

Telangana Ration Card List 2024, Check Name & Status at epds.telangana.gov.in

awaassoft.nic.in – PMAY Gramin Application Status & Beneficiary Details 2024

UP Ration Card List 2024: APL, BPL, NFSA & Antyodaya राशन कार्ड सूची

State Wise SECC 2011 Final BPL List India 2024 – Download PDF & Check Your Name

UP Vidhwa Pension List 2023-24, Status, Apply Online @ sspy-up.gov.in

UP Berojgari Bhatta Yojana 2024 Online Registration / Application Form at sewayojan.up.nic.in

Karnataka Free Laptop Scheme 2024: Online Application & Registration Form PDF @ dce.karnataka.gov.in

UP Kisan Karj Rahat List 2024 – किसान फसल ऋण मोचन योजना लाभार्थी सूची, Registration, Status @ upkisankarjrahat.upsdc.gov.in

Bihar Anganwadi Supervisor Vacancy 2024 – Apply Online @ fts.bih.nic.in, icdsonline.bih.nic.in – आंगनवाड़ी सुपरवाइजर भर्ती

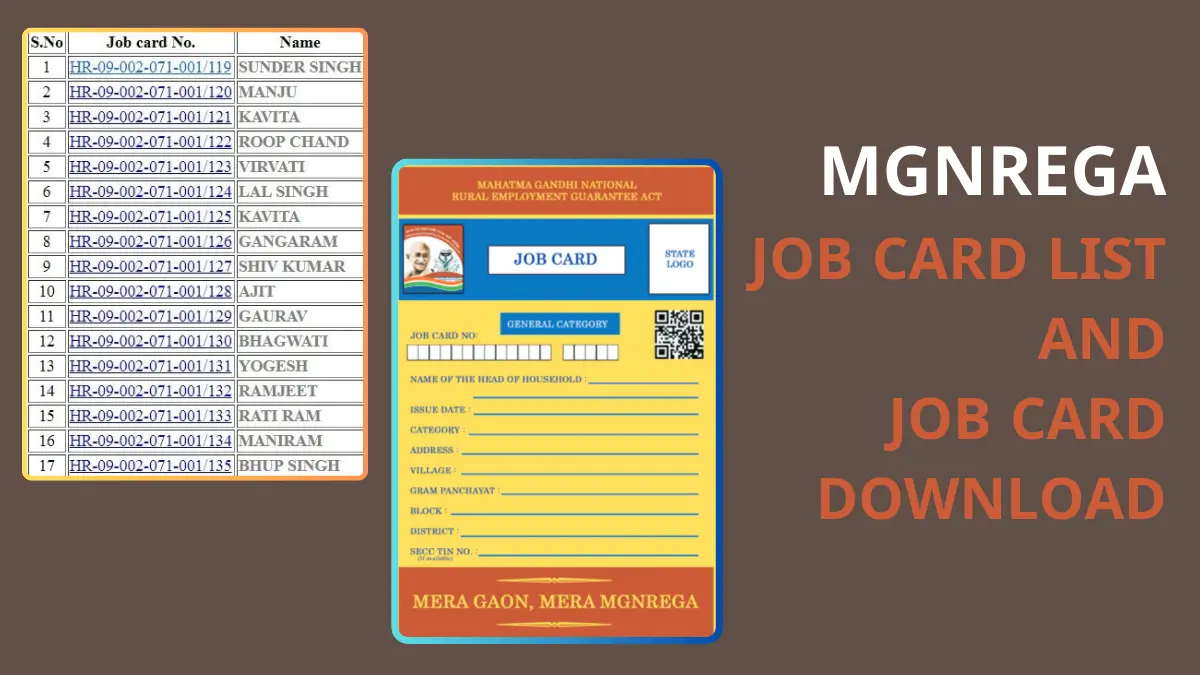

MGNREGA Wage Rates List 2024-25 (मजदूरी दर) – जानें आपके राज्य में मनरेगा के तहत कितनी मजदूरी मिलेगी

Jammu & Kashmir Ration Card List 2024 (JKePDS) Download or Check Your Name @ rcms.jk.gov.in

Didi Ke Bolo – Portal Registration, Whatsapp Phone Number & Contact @ didikebolo.com

Maharashtra CEO Voter List 2024 (PDF Electoral Rolls) – Voter ID Card Download

Assam Voter List 2024 with Photo (PDF Electoral Rolls) – Download Voters ID Card

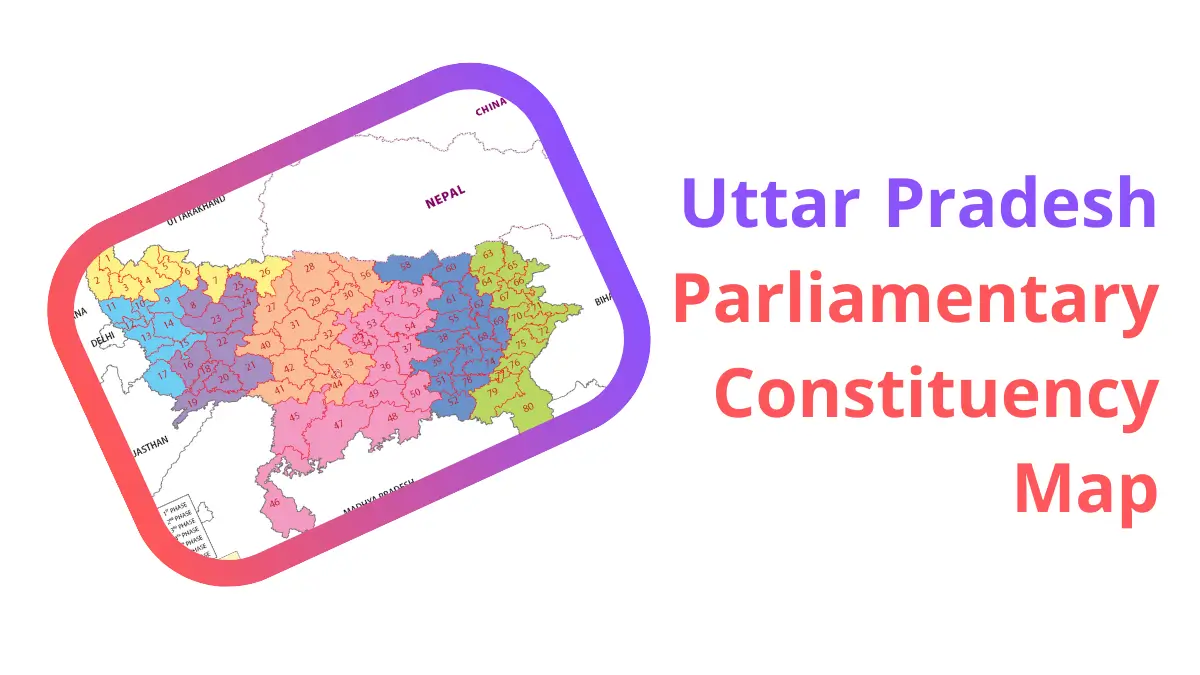

Uttar Pradesh Parliamentary Constituency Map

UP Voter List 2024 (PDF Electoral Roll) – Download Voter ID Card & Voter Slip

सरकारी योजना वेबसाइट के माध्यम से हम आपके लिए लेकर आते हैं केंद्र सरकार और राज्य सरकारों द्वारा चलायी जा रही सभी पुरानी और नई सरकारी योजनाओं के बारे में सम्पूर्ण जानकारी। अब आप भी जानें कैसे आप घर बैठे लाभ उठा सकते हैं उन सभी नयी सरकारी योजनाओं का जो कि प्रधानमंत्री श्री नरेंद्र मोदी ने पिछले 8-9 साल में शुरू की हैं। नरेंद्र मोदी सरकार द्वारा शुरू की गयी सभी सरकारी योजनाओं के बारे में लेटेस्ट जानकारी और मुख्यमंत्री और प्रधानमंत्री योजनाओं के बारे में ताज़ा ख़बरें हिंदी में सिर्फ www.sarkariyojana.com पर।

सरकारी योजना वेबसाइट पर नीचे दिए गए Links पर आप पा सकते हैं प्रधान मंत्री नरेंद्र मोदी के नेतृत्व में केंद्र सरकार द्वारा समाज के विभिन्न वर्गों के लिए शुरू की गई सभी सामाजिक कल्याणकारी सरकारी योजनाओं की सूची और सभी राज्य सरकारों द्वारा शुरू की गयी सरकारी योजनाओं की सूची 2024 हिंदी में।

sarkariyojana.com (Sarkari Yojana) is a dedicated portal to provide latest online information about the government schemes, PM Narendra Modi schemes, new scheme launches, latest updates and changes in government schemes, application forms / registration procedures of all schemes, government mobile apps, government policies and initiatives etc. Also find the complete PM Modi Yojana and Sarkari Yojana List updated till 2024.